2025 Toy Industry Year in Review: How Tariffs Are Driving the Shift to Vietnam, Indonesia & Thailand

The U.S. toy industry just endured its most disruptive year in decades. Tariffs on Chinese imports surged to a staggering 145% before settling at 20%, forcing toy companies worldwide to rethink their reliance on China - which still produces 80% of the world's toys.

Despite the chaos, U.S. toy sales grew 7% through September 2025. But beneath this resilience lies a fundamental transformation: major toy brands are racing to diversify manufacturing to Vietnam, Indonesia, and Thailand.

For companies seeking reliable toy sourcing partners in Southeast Asia, understanding these shifts isn't optional - it's essential for survival.

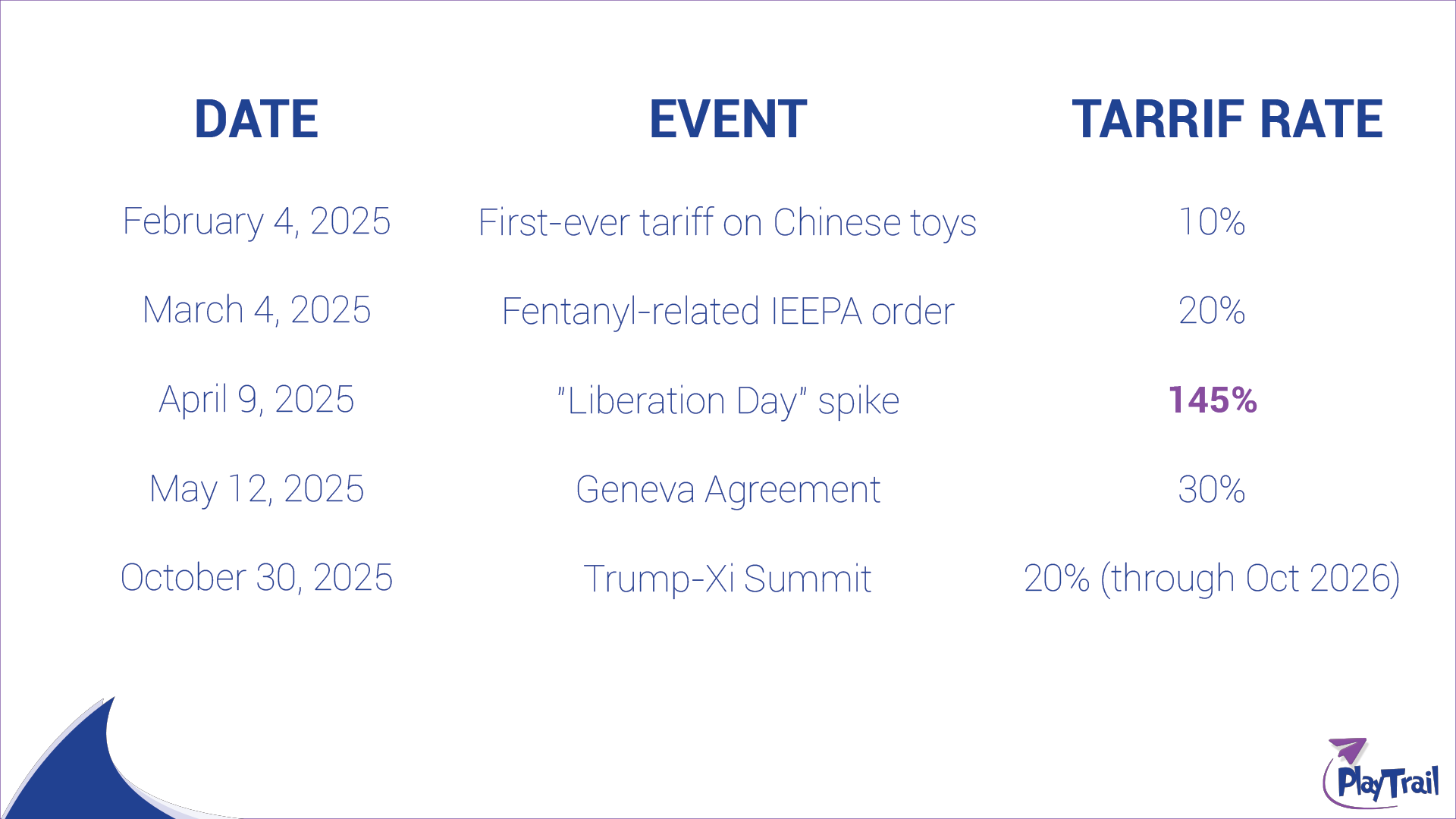

The 2025 Tariff Crisis: A Timeline That Shook the Industry

For the first time in history, toys became subject to U.S. tariffs on Chinese goods - a category specifically exempted during the 2018-2020 trade tensions.

The April peak created a genuine crisis. Nearly 50% of small and medium toy companies reported they could go out of business within weeks. Approximately 60% of manufacturers executed layoffs between May and June. The Toy Association's CEO noted that "the entire industry was on pause for 60 days of prime manufacturing."

Consumer prices responded accordingly, with toys posting a record 2.2% monthly price increase from April to May and overall prices rising 10-30% by holiday season.

Why Toy Brands Are Moving Manufacturing Out of China

The tariff volatility made one thing clear: relying on China for 80% of production is no longer sustainable.

Major players are executing aggressive supply chain diversification:

Mattel's Manufacturing Shift

- Reduced China manufacturing to under 40% by year-end (vs. 80% industry average)

- Targeting no single country to exceed 25% by 2027

- Closed one China factory in 2024, another slated for 2025

- Expanded Mexico operations with a 2.15 million square-foot Monterrey facility

Hasbro's "Asset-Light" Strategy

- Moving from ~50% China sourcing to 30% by 2026

- Emphasizing flexible production models for rapid geographic shifts

Spin Master's Commitment

- Producing 70% of U.S.-destined toys outside China by end of 2025

- Targeting 75-80% by 2026

The message is clear: the "China-only" era of toy manufacturing is ending.

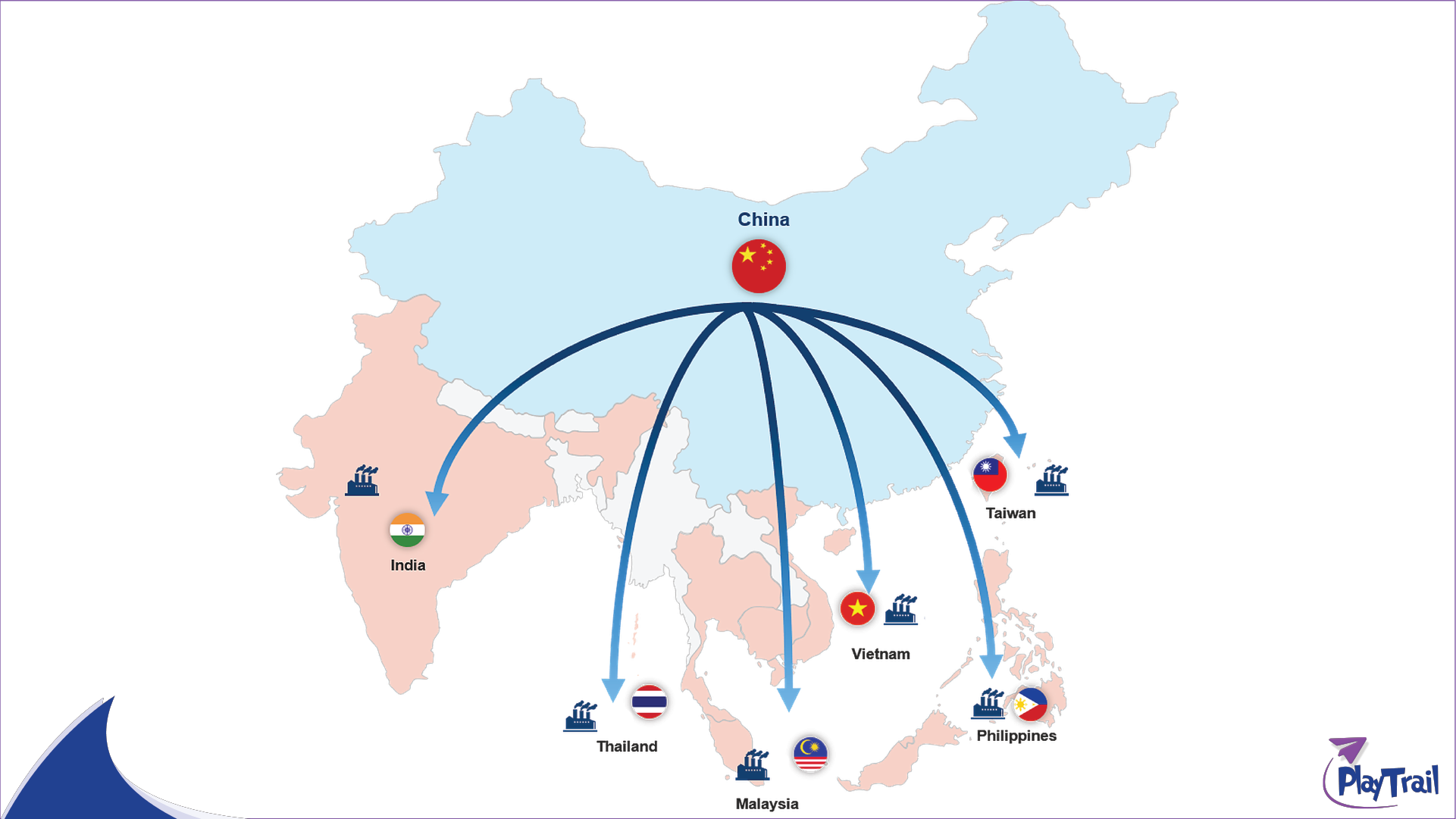

Vietnam: The Leading Alternative for Toy Manufacturing

Vietnam has established itself as the primary beneficiary of the China exodus in toy production. Here's why brands are investing billions in Vietnamese toy manufacturing:

LEGO's $1.3 Billion Vietnam Factory

In April 2025, LEGO officially opened its landmark facility in Binh Duong Province:

- 44-hectare facility with 4,000+ workers

- LEED Platinum certification - LEGO's most sustainable factory globally

- Signals long-term multinational commitment to Vietnam toy production

Vietnam's Competitive Advantages

- Labor costs: $2.99/hour (vs. $6.50/hour in China)

- Export volume: $3.76 billion in toys exported in 2024

- U.S. market focus: 47% of shipments destined for America

- Growing infrastructure: ~100 export-ready toy factories and expanding

Key Considerations for Vietnam Toy Sourcing

While Vietnam offers significant advantages, companies need experienced partners to navigate:

- Quality control systems different from Chinese standards

- Skilled workforce development

- Component dependencies (90% of Vietnam's toy components still come from China)

- Power infrastructure in northern industrial parks

→ Contact Play Trail NOW to explore Vietnam toy sourcing opportunities (link)

Indonesia: Emerging Powerhouse for Toy Production

Indonesia is rapidly becoming a critical destination for toy manufacturing investment in Southeast Asia.

Major 2025 Investments

Early Light International announced a $34 million factory in Kendal Special Economic Zone in October 2025:

- 10,000 workers producing dolls, plush, and figurines

- Focus on North American and European exports

Mattel's Cikarang Expansion:

- New molding center producing approximately 85 million Barbie dolls annually

- Demonstrates confidence in Indonesian manufacturing capabilities

Why Indonesia for Toy Manufacturing?

- Competitive labor costs

- Large, trainable workforce

- Special Economic Zone incentives

- Strategic geographic position for global shipping

Thailand: Sustainable & Specialty Toy Manufacturing

Thailand maintains a distinct niche in the toy manufacturing landscape, particularly for:

- Sustainable wooden toys (companies like PlanToys)

- Premium, eco-friendly products

- Specialty manufacturing requiring precise craftsmanship

For brands prioritizing sustainability - increasingly important as 45% of U.S. parents under 40 now consider environmental impact when purchasing toys - Thailand offers unique advantages.

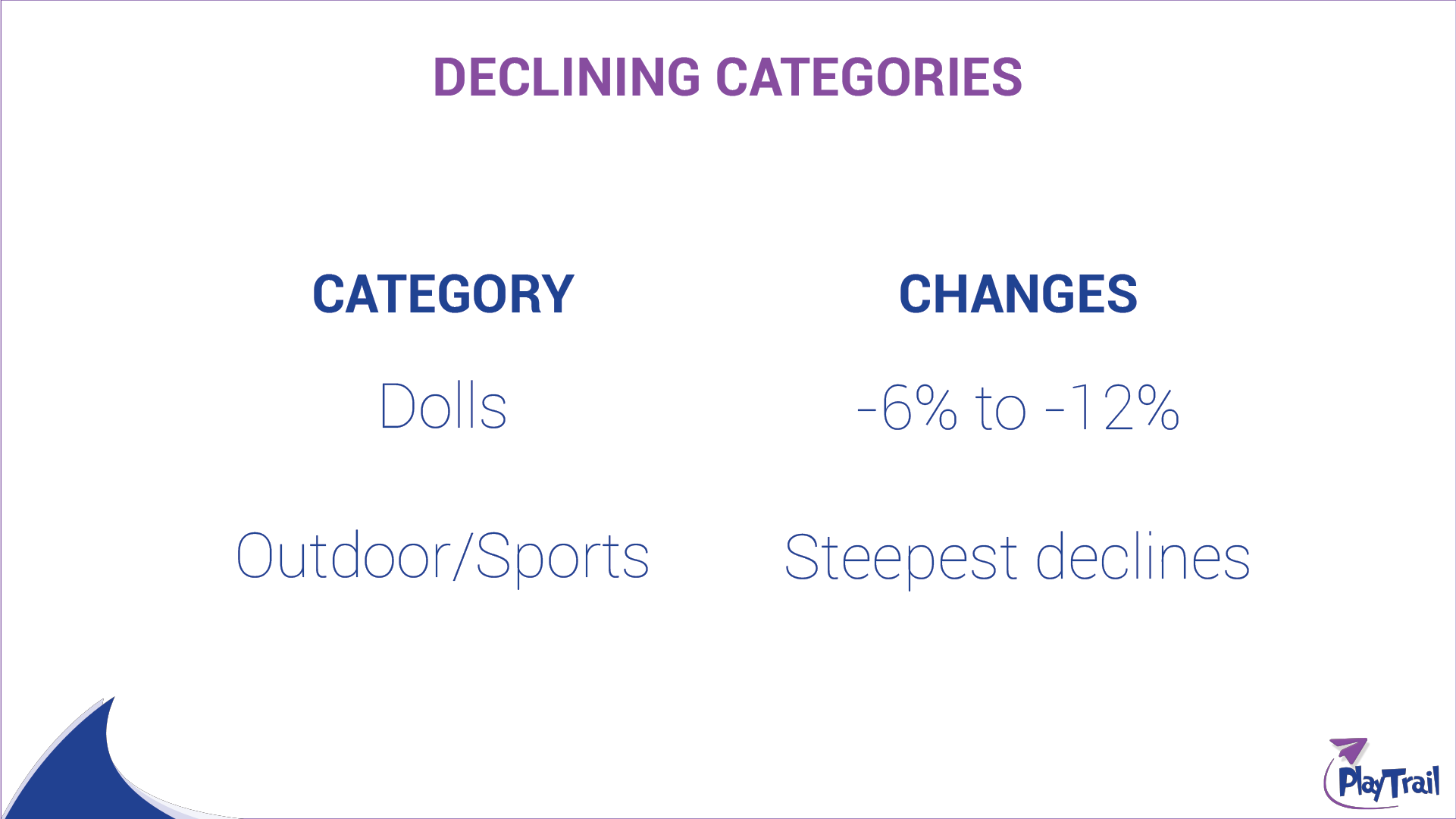

The U.S. Toy Market: Where the Growth Is

Despite tariff turbulence, the American toy market showed surprising strength in 2025:

The "Kidult" Phenomenon

The adult collector market drove exceptional growth:

- Sales to consumers 18+ jumped 18% in H1 2025

- $1.8 billion in Q1 alone

- 19% of adults purchased Pokémon cards for themselves in the past six months

Licensed toys now capture 37% of all U.S. toy sales, gaining nearly 4 share points year-over-year.

What This Means for Your Toy Sourcing Strategy

The 2025 toy industry transformation creates both challenges and opportunities:

Challenges

- China capacity can't be replaced overnight (5,000-10,000 factories vs. ~100 in Vietnam)

- Alternative countries face their own tariff complications

- Quality control requires experienced local partners

- Raw material supply chains need restructuring

Opportunities

- First-mover advantage in establishing Southeast Asian supplier relationships

- Cost savings through strategic manufacturing placement

- Reduced tariff exposure through geographic diversification

- Sustainability gains increasingly valued by consumers

Key Industry Trends to Watch in 2026

EU Toy Safety Regulation

New requirements formally adopted November 2025, with full implementation by August 2030:

- Bans on endocrine disruptors, PFAS, and bisphenols

- Mandatory Digital Product Passports (QR-code compliance documentation)

- Mental health risk assessments for connected toys

AI Integration

- Global AI toy market reached $35-42 billion in 2025

- Projected 14-20% annual growth

- Mattel partnered with OpenAI for AI-powered interactive toys

Sustainability Requirements

- 45% of U.S. parents under 40 consider environmental impact

- EU Green Claims Directive will require verifiable evidence for sustainability marketing

- Major brands targeting 100% recycled/recyclable materials by 2030

Partner with Play Trail for Southeast Asia Toy Sourcing

The era of single-source Chinese manufacturing is ending. Leading toy brands are building diversified supply chains across Vietnam, Indonesia, and Thailand - and the window for establishing strong supplier relationships is now.

Play Trail offers:

- ✓ Established factory networks across Vietnam, Indonesia, and Thailand

- ✓ Quality control systems that matches Western brand standards

- ✓ End-to-end sourcing from prototyping to delivery

- ✓ Expertise navigating tariff and local compliance requirements

- ✓ Transparent pricing and production timelines

Whether you're a major brand accelerating China diversification or a growing company establishing your first Southeast Asian supply chain, Play Trail has the expertise and relationships to make it happen.

Contact Play Trail Today (link) | Check out our collection of analysis and articles (link)

Sources: The Toy Association, Circana, CNN, CNBC, Fortune, Manufacturing Dive, Vietnam Briefing, industry earnings calls, and regulatory filings.

Frequently Asked Questions

Why are toy companies leaving China?

The 2025 tariff crisis - with rates reaching 145% - exposed the risk of over-reliance on Chinese manufacturing. Companies are now targeting 40% or less China production within two years to reduce tariff exposure and supply chain vulnerability.

Which country is best for toy manufacturing outside China?

Vietnam leads as the primary alternative, with $3.76 billion in toy exports and major investments from LEGO and others. Indonesia offers scale for dolls and plush, while Thailand excels in sustainable wooden toys. The best choice depends on product type, volume, and sustainability requirements.

How much cheaper is toy manufacturing in Vietnam vs. China?

Labor costs in Vietnam average $2.99/hour compared to $6.50/hour in China - over 50% savings. However, total cost comparisons should account for quality control, logistics, and component sourcing.

What are the main challenges of sourcing toys from Vietnam?

Key challenges include limited factory capacity (100 vs. 5,000+ in China), component dependencies on Chinese raw materials, quality control system differences, and skilled workforce availability. Working with experienced sourcing partners mitigates these risks.

How can Play Trail help with toy sourcing in Southeast Asia?

Play Trail specializes in toy sourcing across Vietnam, Indonesia, and Thailand, offering established factory networks, quality control expertise, and end-to-end supply chain management for brands diversifying from China.

Hợp tác với chúng tôi